PCI DSS Compliance: Secure Your Payment Data

Discover the importance of PCI DSS, the global standard for payment security that protects cardholder data and ensures your organisation meets the highest standards of data protection.

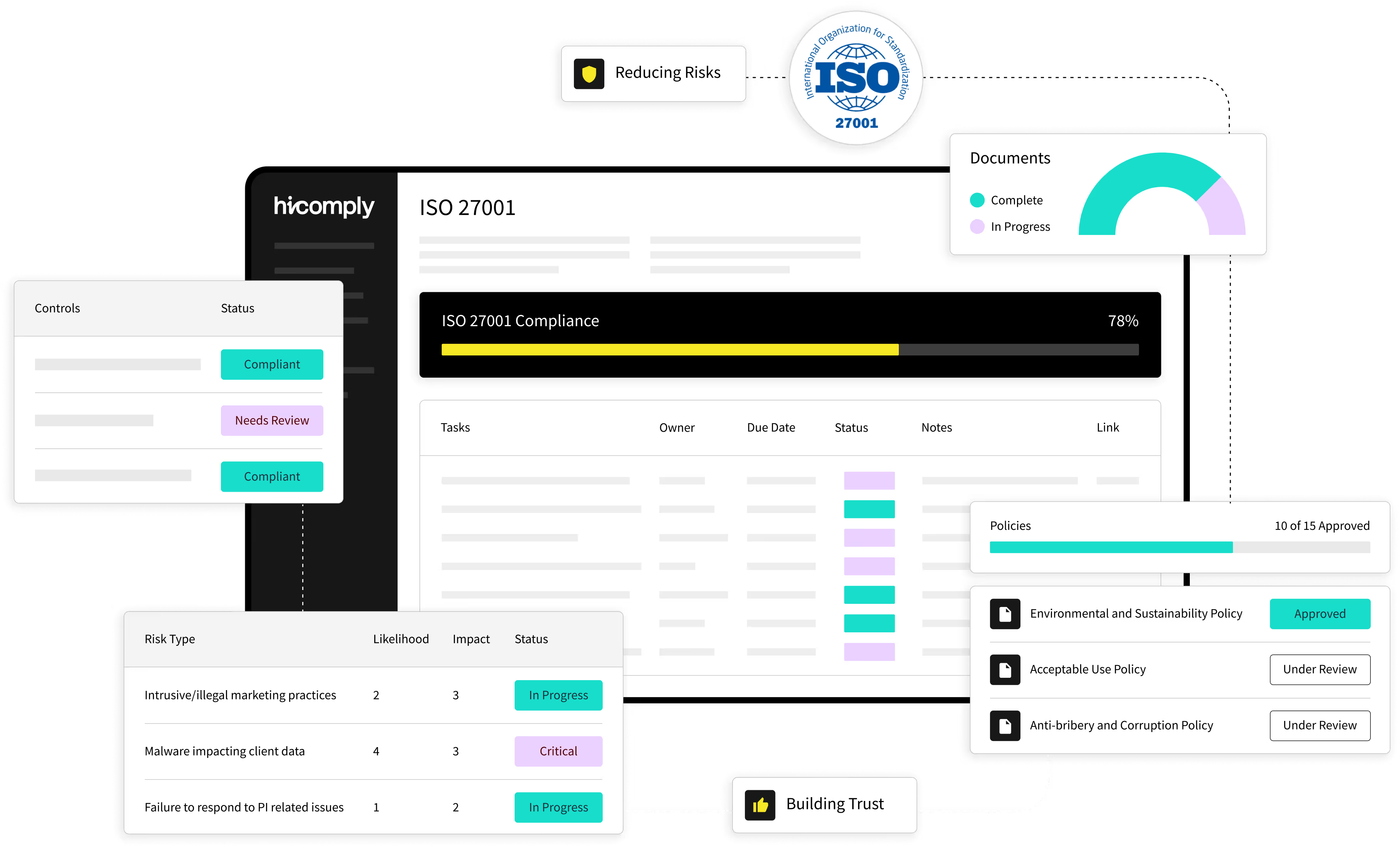

With Hicomply, you get an all-in-one platform that automates and simplifies every step, helping you secure sensitive data, demonstrate accountability, and strengthen your business.

What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder information and reduce the risk of data breaches. It applies to any organisation that accepts, processes, stores, or transmits credit card data. Compliance with PCI DSS is crucial for maintaining customer trust, safeguarding sensitive data, and preventing costly fines due to security breaches.

PCI DSS Risk Assesment Benefits

Risk assessments are a critical component of PCI DSS compliance. These assessments help organisations identify and mitigate vulnerabilities within their payment card processing environment.

PCI DSS 4.0: What’s Changed?

PCI DSS 4.0, the latest version of the standard, introduces updated requirements to address evolving cybersecurity threats and enhance payment security. Some key changes include:

.avif)

.avif)

What are the Benefits of PCI DSS?

PCI DSS compliance provides multiple advantages that go beyond just regulatory requirements. Achieving and maintaining PCI DSS compliance helps organisations:

What are the Benefits of PCI DSS?

PCI DSS compliance provides multiple advantages that go beyond just regulatory requirements.

Connect, Collect, and Automate

Explore Hicomply—the all-in-one ISMS platform with 300+ integrations to power up your compliance.

.svg)

PCI DSS Assesment Method

These assessments help organisations identify and mitigate vulnerabilities within their payment card processing environment.

Evaluating System Vulnerabilities

Regularly identifying weaknesses in systems and processes that could expose cardholder data to risks.

Testing Security Controls

Verifying that implemented controls effectively protect against identified risks and meet PCI DSS requirements.

Creating an Incident Response Plan

Developing a plan to respond to and mitigate potential security breaches or incidents swiftly.

Practical Applications & Workflow Simplified

Hicomply’s ISMS solutions help you obtain, maintain and manage all your information security certifications. 90% of the work is already done for you.